Saker Aviation Services, Inc. Announces Financial Results For The Six Months Ended June 30, 2016

Revenue of $7.03 Million in 2016 Flat Versus $7.04 Million in 2015

Operating Income of $782,000 in 2016 down 10.7% Versus $876,000 in 2015

NEW YORK, NY, August 15, 2016/PR Newswire/ – Saker Aviation Services, Inc. (SKAS),

an aviation services company specializing in ground-based services to the general

aviation marketplace, today announced its financial results for the six months ended June

30, 2016.

Revenue and operating income in the six months ended June 30, 2016 of $7,031,568

and $782,368, respectively, are flat and down 10.7 percent, respectively, as compared to

revenue of $7,044,851 and operating income of $876,261 in the six months ended June

30, 2015. The initial phase of mandatory reductions in air tour activity at the Company’s

New York operation, which occurred on June 1, 2016, negatively impacted the year-overyear

revenue comparison. At the same time, fee payments to New York City in

connection with those operations increased 38.2 percent, which depressed operating

income in 2016 as compared to 2015.

“The combination of higher fee payments to New York City and the first stage of

mandatory air tour reductions drove unfavorable comparisons this year as compared to

2015. While the higher payments to the City were timing related, the upcoming second

stage of mandatory air tour reductions on October 1, 2016 will continue to affect top-line

results,†stated Ron Ricciardi, the Company’s President. “In the second half of the year

we’ll experience a favorable shift in fee payments to New York, as those fees are based

on gross receipts from our New York operation. The combination of the first two stages

of air tour reductions, however, will continue the anticipated pressure on operating income

for the balance of 2016 and into 2017.â€

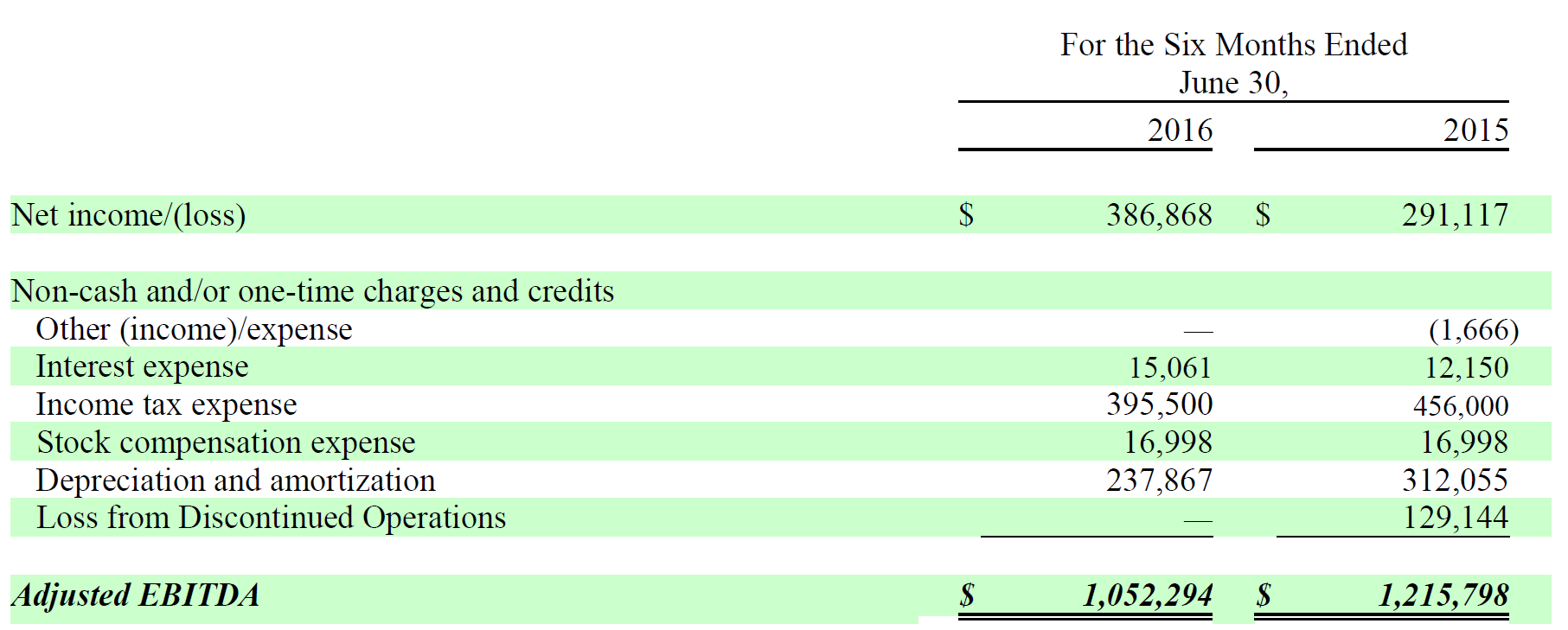

The Company also reported Adjusted EBITDA1 of $1,052,294 for the six months ended

June 30, 2016, a decrease of $163,504 or 13.4 percent as compared to Adjusted EBITDA

of $1,215,798 in the six months ended June 30, 2015. Please see footnote 1 below for

the Company’s definition of Adjusted EBITDA, a description of why the Company uses

Adjusted EBITDA and important disclaimers regarding Adjusted EBITDA, which is a non-

GAAP measure. A reconciliation of Adjusted EBITDA to the appropriate GAAP measure

is also included in footnote 1.

About Saker Aviation Services, Inc.

Saker Aviation Services (www.SakerAviation.com), through our subsidiaries, operates in

the aviation services segment of the general aviation industry, in which we serve as the

operator of a heliport, a fixed base operation (“FBOâ€), and as a consultant for a seaplane

base that we do not own. FBOs provide ground-based services, such as fueling and

aircraft storage for general aviation, commercial and military aircraft, and other

miscellaneous services.

CONTACT:

Saker Aviation Services, Inc.

Ronald J. Ricciardi, President

1.212.776.4046

[email protected]

Note Regarding Forward-Looking Statement

This press release contains “forward-looking statements” within the meaning of Section

27A of the Securities Act and Section 21E of the Securities Exchange Act of 1934, as

amended (the “Exchange Actâ€). Forward-looking statements can be identified by words

such as “anticipates,†“intends,†“plans,†“seeks,†“believes,†“estimates,†“expects†and

similar references to future periods. These statements may include projections of

revenue, provisions for doubtful accounts, income or loss, capital expenditures,

repayment of debt, other financial items, statements regarding our plans and objectives

for future operations, acquisitions, divestitures and other transactions, statements of

future economic performance, statements of the assumptions underlying or relating to

any of the foregoing statements and statements other than statements of historical fact.

Forward-looking statements are based on the Company’s current expectations and

assumptions regarding its business, the economy and other future conditions. Because

forward-looking statements relate to the future, they are subject to inherent uncertainties,

risks and changes in circumstances that are difficult to predict. The Company’s actual

results may differ materially from those contemplated by the forward-looking statements.

The Company therefore cautions readers of this press release against relying on any of

these forward-looking statements because they are neither statements of historical fact

nor guarantees or assurances of future performance. Important factors that could cause

actual results to differ materially from those in the forward-looking statements include the

Company’s services and pricing, general economic conditions, its ability to raise

additional capital, its ability to obtain the various approvals and permits for the acquisition

and operation of FBOs and the other risk factors contained under Item 1A of the

Company’s Annual Report on Form 10-K for the year ended December 31, 2015.

Any forward-looking statement made in this press release speaks only as of the date on

which it is made. Factors or events that could cause the Company’s actual results to differ

may emerge from time to time and it is not possible to predict all of them. The Company

undertakes no obligation to publicly update any forward-looking statement, whether as a

result of new information, future developments or otherwise, except as may be required

by law.

-FINANCIAL TABLES TO FOLLOW –

Explanation of Adjusted EBITDA, a Non-GAAP Financial Measure

The Company defines Adjusted EBITDA as earnings before interest, taxes, depreciation

and amortization, as adjusted for stock based compensation expense and other income

and expense items. The Company believes that Adjusted EBITDA, which is a financial

measure that is not defined by Generally Accepted Accounting Principles (“GAAPâ€), is a

useful performance metric because it eliminates non-cash and/or non-recurring charges

to earnings. It is important to note that non-GAAP measures such as Adjusted EBITDA

should be considered in addition to, not as a substitute for or superior to, net income,

cash flows, or other measures of financial performance prepared in accordance with

GAAP. A reconciliation of net income to Adjusted EBITDA is as follows for the six months

ended June 30, 2016 and 2015.

CONTACT SAKER AVIATION

CONTACT SAKER AVIATION

Do you have an inquiry regarding our FBOs

or charter services?

We'd love to hear from you!